If you’re a homeowner, you might be torn on whether or not to sell your house right now. Maybe that’s because you don’t want to take on a higher mortgage rate on your next home. If that’s your biggest hurdle, understanding how your equity is a game changer for homeowners looking to sell may be exactly what you need to help you feel more comfortable making your move.

We recently wrote about the two big issues the housing market is currently facing – limited inventory and rate-locked homeowners. If you took advantage of the historically low interest rates we experienced over the last few years, and now with rates inching toward 7%, you may feel that you either don’t want to give up your lower rate or cannot afford to move into a new home with rates that high. Today’s blog discusses how the equity you’ve built in your present home can be the ticket to selling your house and buying a new one without having to worry about interest rates.

What Equity Is and How It Works

Equity is the current value of your home minus what you owe on the loan. And over the past few years, that equity has been growing far faster than you might expect. This has remained so even in a time of higher interest rates.

Over the last few years, home prices have risen dramatically, and that gave your equity a big boost very quickly. While the market has started to normalize, there continues to be an imbalance between the number of homes on the market for sale and the number of buyers who are looking to buy a new home. And, because homes are in such high demand prices are continuing to rise today. As Rob Barber, CEO of ATTOM, a property data provider, explains:

“Equity levels were high even during the recent downturn, and now they are going back up and better than ever.”

How Equity Benefits You in Today’s Market

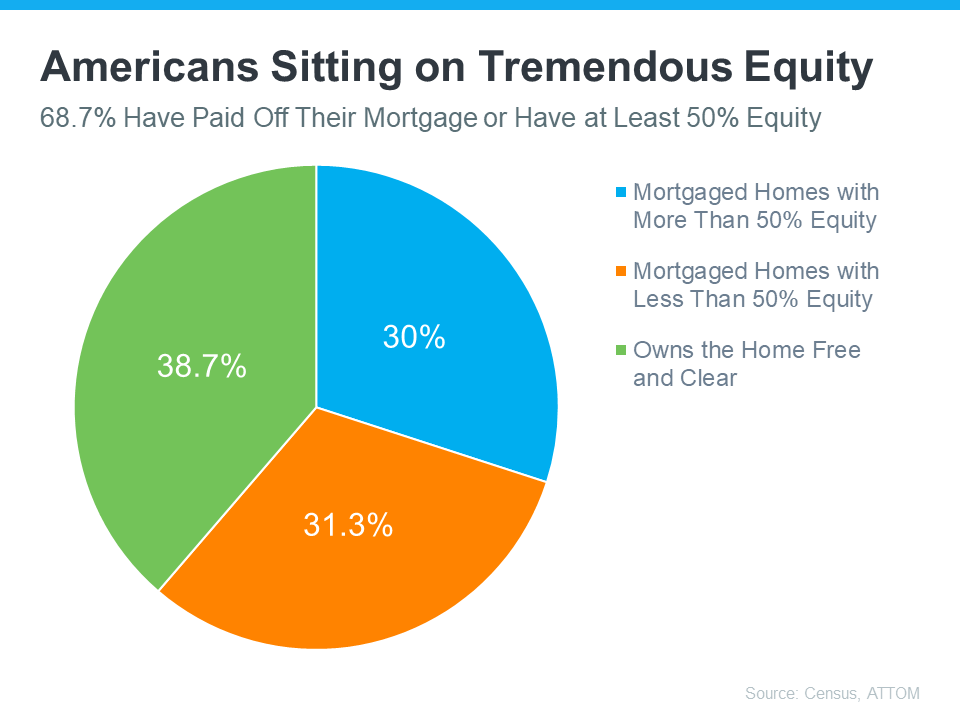

With today’s affordability challenges, that equity can be a game changer when you want to move. Here’s why. Based on data from ATTOM and the Census, nearly two-thirds (68.7%) of homeowners have either paid off their mortgages or have at least 50% equity (see chart below):

That means roughly 70% have a tremendous amount of equity right now.

When you sell your house, you can use your equity to help with your next purchase. It could be some (if not all) of what you’ll need for your next down payment. It may even be enough to allow you to put a considerably larger down payment on your next home, so you don’t have to finance quite as much.

And, if you’ve been in your current house for years, you may have even built up enough equity to pay in all cash. If that’s true for you, you’ll be able to avoid borrowing altogether, so you won’t have to be concerned about today’s mortgage rates.

How To Find Out How Much Equity You Have

The best way to learn how much you have is to reach out to a trusted real estate agent for a Professional Equity Assessment Report (PEAR). A PEAR is a custom evaluation of your home’s cash value. By knowing what you currently owe on your mortgage and estimating the value of your home, you can determine your home’s approximate equity. This is a powerful tool to help you make a confident decision in your home selling process.

Bottom Line

If you’re planning to make a move, the equity you’ve gained can make a big impact on how much, if any, mortgage you’ll need. To find out just how much equity you have in your current home and how you can use it to fuel your next purchase, let’s connect.