Are you still renting and paying your landlord’s mortgage? Are you thinking about buying a home? While today’s mortgage rates might seem intimidating, we have two solid reasons for you to consider that explain the perks of buying over renting. And, if you’re ready and able, it could still be a smart move to get your own place now.

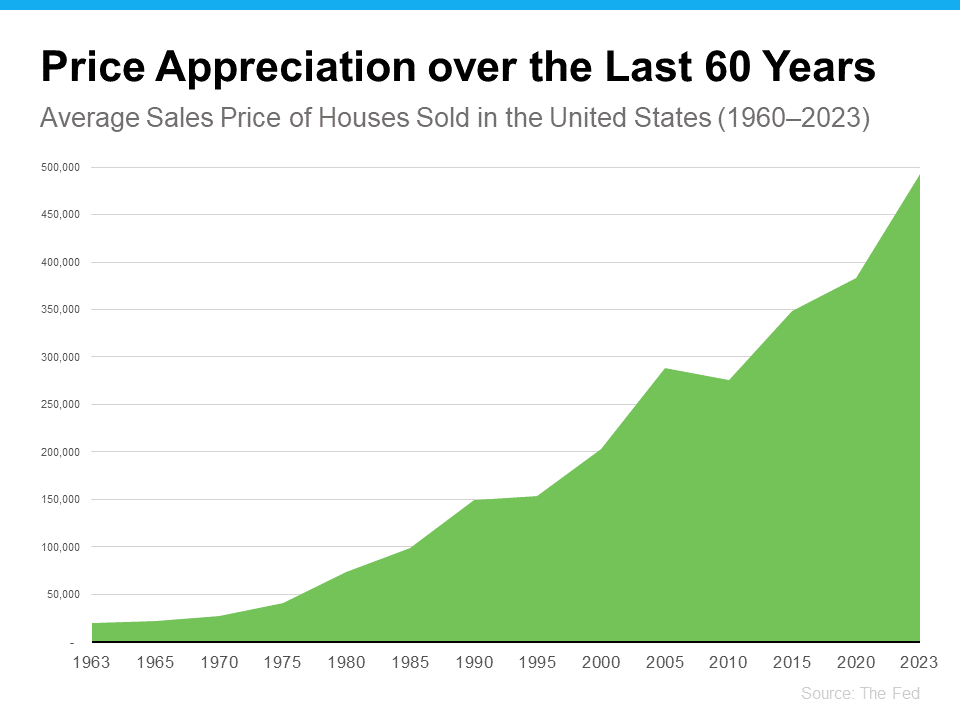

1. Home Values Typically Go Up Over Time

Over the past year or so there’s been some confusion about where home prices are headed. Make no mistake about it, nationally they’re still going up. In fact, over the long term, home prices almost always go up (see graph below):

Using data from the Federal Reserve (the Fed), you can see the overall trend is home prices have climbed steadily for the past 60 years. There was an exception during the 2008 housing crash when prices didn’t follow the normal pattern, but generally, home values kept rising.

This is a big reason why buying a home can be better than renting. As home values increase, and you pay down your mortgage, you build equity. Over time, this growing equity can dramatically increase your net worth. The Urban Institute says:

“Homeownership is critical for wealth building and financial stability.”

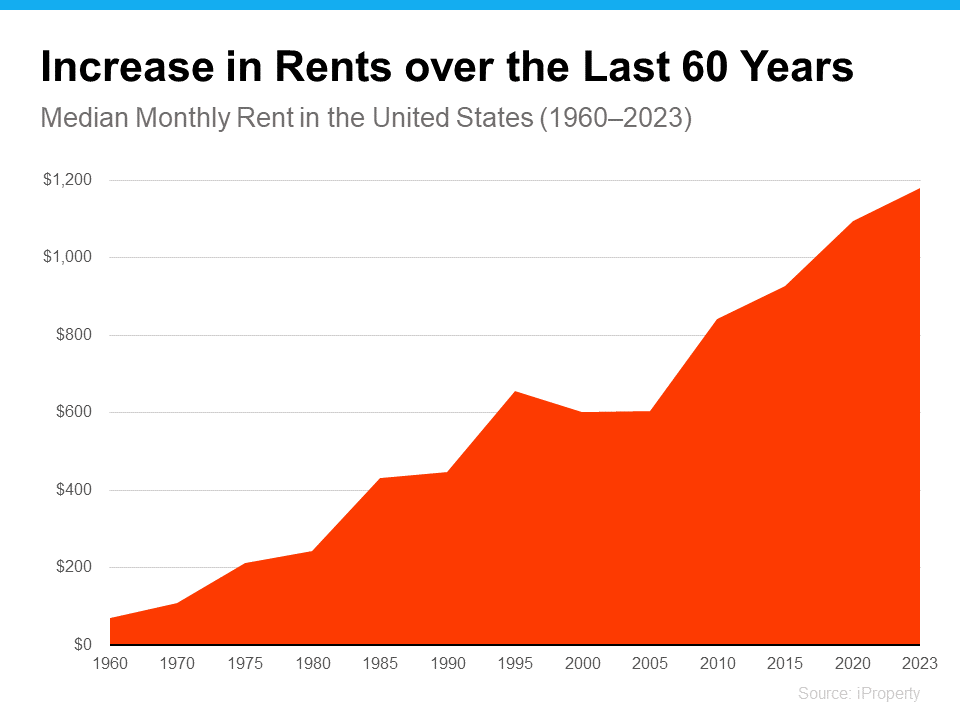

2. Rent Keeps Rising in the Long Run

Here’s another reason you may want to consider buying a home instead of renting – year-over-year rents just keep going up. Sure, it might be cheaper to rent right now in some areas, but every time you renew your lease or sign a new one, you’re likely to feel the squeeze of your rent getting higher. According to data from iProperty Management, rent has been going up pretty consistently for the last 60 years, too (see graph below):

So how do you escape the cycle of rising rents? Buying a home with a fixed-rate mortgage helps you stabilize your housing costs and say goodbye to those annoying rent increases. That kind of stability is a big deal.

Remember, your housing payments are like an investment. So the question to ask yourself is, do you want to invest in yourself or keep paying your landlord’s mortgage?

When you own your home, you’re investing in your own future. And even when renting is cheaper, that money you pay every month is gone for good and you have nothing to show for it. And, considering the increase in rents across the country, even with today’s mortgage rates there’s a good chance your mortgage payment will not be higher than your rent payment. And, it could be lower!

As Dr. Jessica Lautz, Deputy Chief Economist and VP of Research at the National Association of Realtors (NAR), says:

“If a homebuyer is financially stable, able to manage monthly mortgage costs and can handle the associated household maintenance expenses, then it makes sense to purchase a home.”

Bottom Line

At Bay Shores Real Estate we specialize in helping our clients find the home of their dreams, and we hold their hand throughout the entire process. So, if you’re tired of your rent continually going up and want to explore the many benefits of homeownership, let’s talk to explore your options.